9 Simple Techniques For Guided Wealth Management

9 Simple Techniques For Guided Wealth Management

Blog Article

The Definitive Guide for Guided Wealth Management

Table of ContentsEverything about Guided Wealth ManagementAn Unbiased View of Guided Wealth ManagementGuided Wealth Management Fundamentals ExplainedSee This Report about Guided Wealth ManagementThe Basic Principles Of Guided Wealth Management

With this being said, you should not be expected to think this view with no solid reasoning (financial advisor redcliffe). We have provided five factors to aid show why an economic organizer can be so useful. The largest challenge standing in your means of achieving higher degrees of wealth typically has no relation to having moneyYou would not begin cooking an intricate wedding event cake if you didn't have the dish and abilities necessary to make it. Building greater wealth is similar in that regard. https://www.video-bookmark.com/bookmark/6453473/guided-wealth-management/. You need to have the expertise and abilities necessary to comprehend the trip to attaining greater wealth, if you ever desire to make it

Because emotional choice making is just one of the worst adversaries of effective investing. Loss hostility predisposition is an ideal instance of this, which is when an individual favors to avoid losses greater than making comparable gains, due to mindsets created from past experiences. The trouble with loss hostility predisposition for that reason is that it holds people back from spending.

A Biased View of Guided Wealth Management

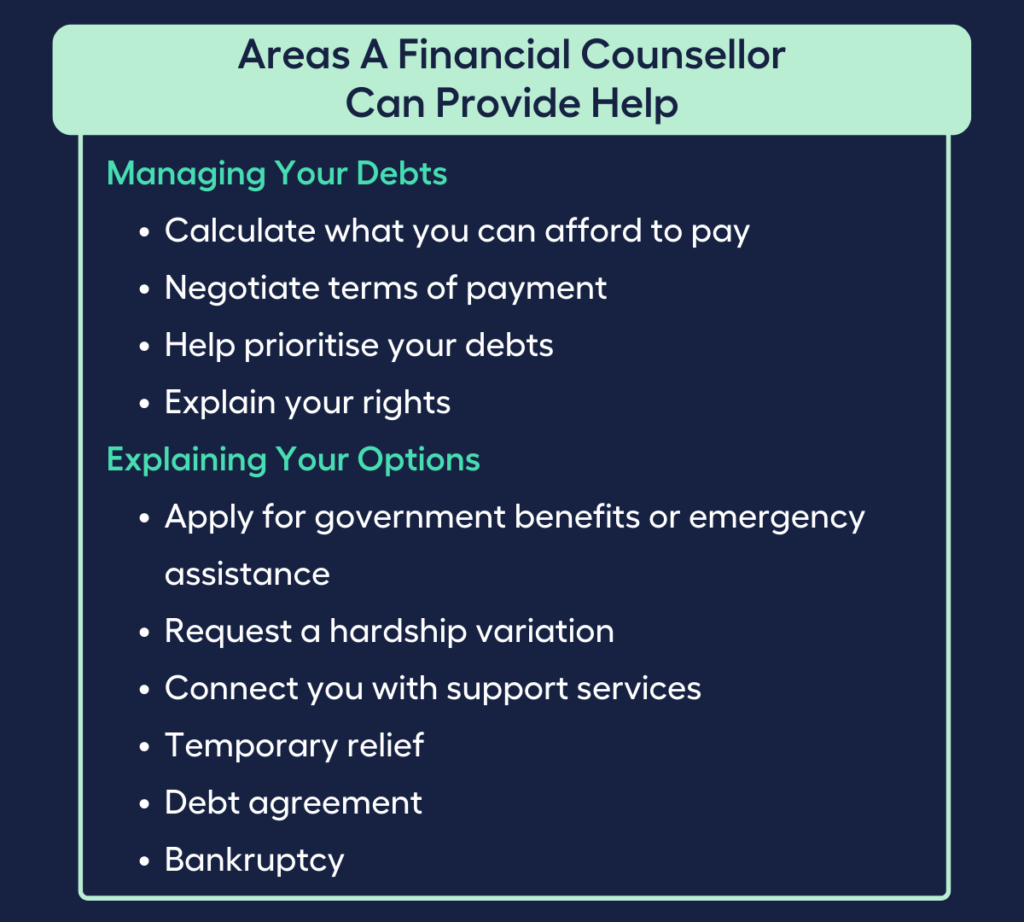

Numerous individuals that are experiencing money problems, are also enduring from some level of debt. In other situations, that financial obligation can be quite extreme, and the path to getting out of that debt might seem nonstop at times.

It do without stating that an economic organizer can not eliminate financial debt overnight, yet they will certainly be able to aid you by offering you with distinct options you might not have considered or else. Among the biggest benefits of an economic planner is the time they can bring you. Organizers can work to relieve greater quantities of time for you, via a selection of methods.

The demand to do all your bookkeeping and personal financing on your own can also be eased by a monetary planner, which in-turn conserves you lots of hours a week you may otherwise spend finishing these tasks. In doing so, this also gives you with the confidence and safety and security of recognizing that your financial resources are being looked after.

Which is most likely due to the fact that every person around you remains in the very same circumstance, of trying to do what's best for them and their household. If you really feel as though this relates to you, which you are usually bewildered by finances and trying to intend for the future, after that bringing in an economic planner can provide you the one thing you require most, being assistance.

Unknown Facts About Guided Wealth Management

You may discover that reviewing your financial resources with buddies or family members may be unpleasant, but things are different with a monetary coordinator. They have no pre-existing opinion of you and don't m mix in additional info your social circles - wealth management brisbane. Providing you access to a person entirely neutral, that is eager to aid you and not evaluate your circumstance

They can not make you rich overnight. Nonetheless, they can aid to highlight the properties and advantages you currently have, whilst proceeding on to take advantage of those and develop far better monetary security in time. Be that by aiding you to begin small amounts, or to accumulate a nest egg for your.

What Does Guided Wealth Management Do?

Everybody that has cash (and that is virtually everyone) can profit from monetary advice at some time in their life. Nonetheless, lots of people are left asking yourself if they can get the exact same results with a do it yourself strategy; if expert advice is also economical for them; and what they might get in return for the annual charge they are paying.

You need to know that financial preparation is not simply for the affluent. Your economic success doesn't only depend on exactly how much money you make, yet exactly how much you conserve and invest.

This is necessary not even if it's financially wise, but also because. Offered the harsh overview provided above, lots of people will have some cash flow or financial investments to begin with, which your consultant would make use of to develop added value and develop your wide range. You may still be unsure if you have the investable possessions or yearly revenue to validate seeing a financial organizer or getting assist with an investment strategy.

Similarly, they can not make you affluent overnight. They can assist to highlight the possessions and advantages you currently have, whilst continuing on to utilize those and build much better financial security over time. https://www.nulled.to/user/6247367-guidedwealthm. Be that by helping you to start little amounts, or to develop a nest egg for your

The Best Guide To Guided Wealth Management

Because of this, it's time to stop looking at economic planners as just beneficial for those who are already rich. Start relying on your own trip, employ an economic coordinator and locate your own path to riches today! We hope this offered you with some clearness in regards to the many benefits connected with working with an economic planner.

This might shock you! You must understand that monetary planning is not just for the rich. Your monetary success does not only depend upon just how much cash you make, however exactly how much you save and invest. Deciding if expert suggestions is a good concept for you boils down to whether it is or will.

This is necessary not just since it's financially sensible, yet likewise because. Provided the harsh guide provided above, lots of people will certainly have some capital or financial investments to begin with, which your consultant would utilize to create added value and build your riches. You could still be unclear if you have the investable possessions or annual income to warrant seeing a monetary planner or getting aid with an investment strategy.

Report this page